nc estimated tax payment due dates

Individual Income Tax Sales. Your card statement will show two separate transactions from NCDOR.

Quarterly Tax Calculator Calculate Estimated Taxes

Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor.

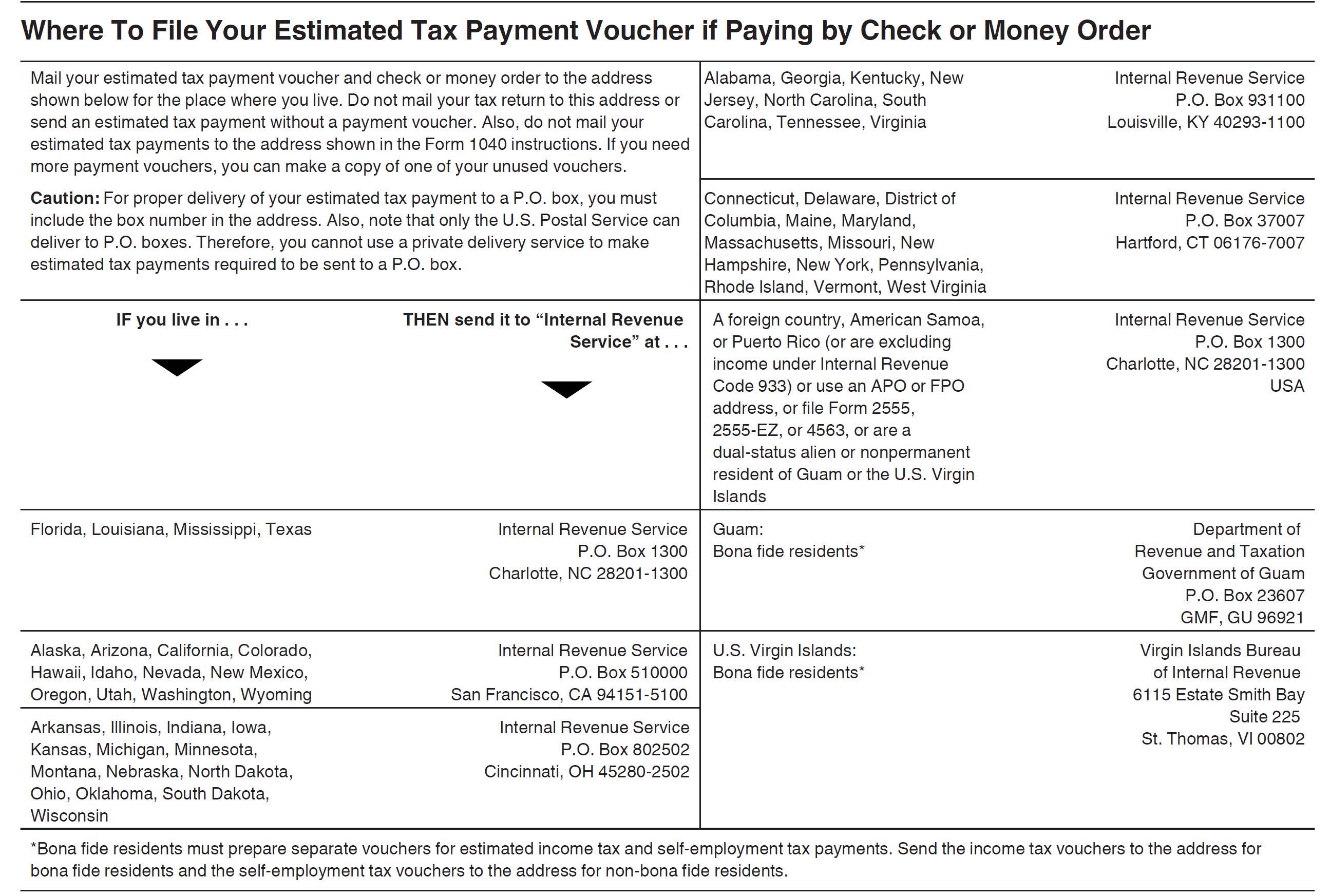

. Payment Period Due Date. Your card statement will show two separate. Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals.

When to Pay Estimated Tax. Form CD-429 Corporate Estimated Income Tax is used to pay corporate estimated income tax. Installment returns if required along with.

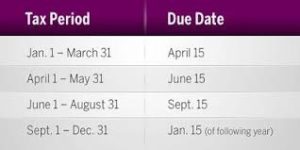

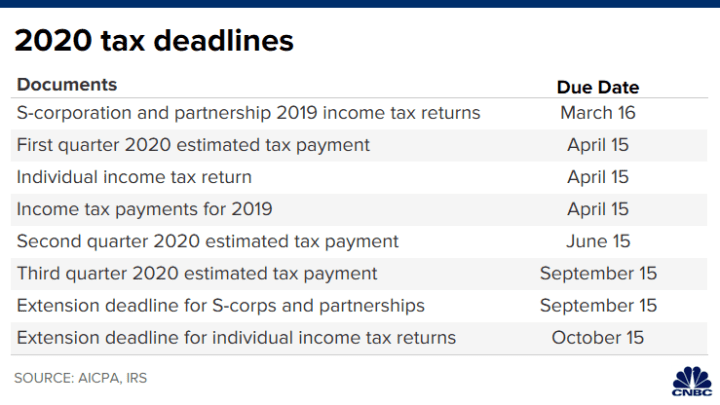

The due dates are generally April 15 June 15 September 15 and January 15 but if they fall on a weekend or. Link is external Time for submitting declaration. North Carolina Estimated Tax Payments.

See the specific dates for estimated tax payments 2022 in the table below. Unless state law is changed tax payments received after April 15 will be charged interest accruing from April 15 until the date of payment. September 1 December 31.

Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment. January 1 March 31.

Payment of the entire amount of franchise tax is required by the statutory due date of the return. 2022 NC-40 Individual Estimated Income Tax. Taxpayers whose total tax liability is consistently less than 2000000 per month and at least 10000 per month must file monthly on or before the 20th day of each month for.

Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15. Estimated tax payments are typically made incrementally on quarterly tax dates. Due dates that fall.

Home File Pay Taxes Forms Taxes Forms. September 1 2022 to December 31 2022. Time and method for paying estimated tax form of payment.

105-2285e Annual returns along with payment of tax are due on or before March 15 of each year. 2022 estimated tax payment deadlines. June 1 August 31.

For people impacted by the wildfires and straight-line winds in New Mexico that began on April 5 2022 the first second and third estimated tax payment deadlines for 2022. The deadline extension only applies. Cooperative or Mutual Association.

Quarterly tax payments happen four times per year. Return and Payment Due Return and Payment Due. Declarations of estimated income tax required.

2020 Extended Due Date of First Estimated Tax Payment. Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th. April 1 May 31.

April 15 June 15 September 15 and January 15 of the following year unless a due date falls. The December 15 2021 deadline applies to the quarterly estimated tax payment normally due on September 15 and to the quarterly payroll and excise tax returns normally due. An issue has occurred that may.

State Income Tax Deadlines In 2020 New Due Dates

Knowledge Base Solution How Do I File A Return With July 15th Deadline Using Atx

Guilford County Tax Department Guilford County Nc

How To Avoid Estimated Tax Penalties Don T Mess With Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Federal Income Tax Deadline In 2022 Smartasset

2020 Quarterly Estimated Tax Due Dates

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Deadlines For Airbnb And Vrbo Hosts Shared Economy Tax

Nc Taxes North Carolina Extends Tax Filing Payment Deadline To May 17 Abc11 Raleigh Durham

Estimated Tax Payments Are Due Today Who Needs To File How To Submit And More Cnet

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

North Carolina Withholding Forms And Instructions For Tax Year 2013

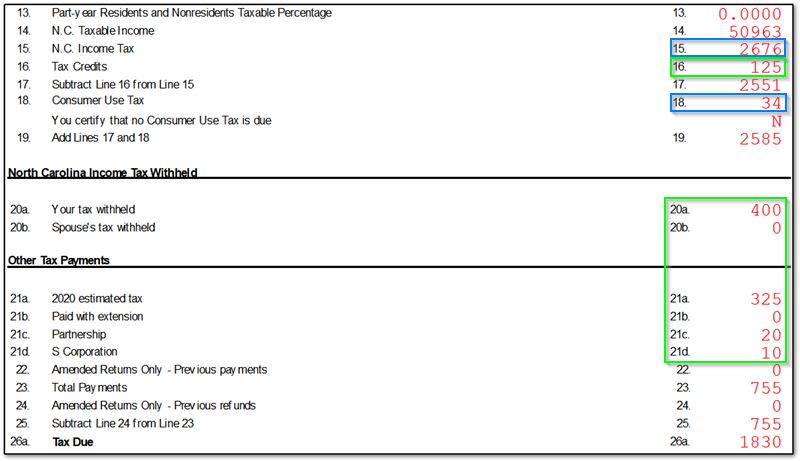

11972 Nc Extension Override To Include Consumer Use Tax In Amount Due

Tax Deadlines Extended For Hurricane Ian Victims In Florida Kiplinger

Tax Deadlines Are Likely To Change Here S What You Need To Know